What Makes a Car Appreciate in Value and Become a Classic? (7 Simple Checks)

Table of Contents

It’s well known that the majority of cars will depreciate over time, some more quickly than others. However, there are certain cars that actually appreciate in value. When buying a car, you may want to choose one that you think is destined for the future classic hall of fame.

Here at The Car Investor we pride ourselves on identifying which cars are likely to become classics, and which will end up in the scrapheap. So we’ve put together a set of criteria to base our decisions on.

Here are the seven checks in detail to help you decide which cars are likely to increase in value and become future classics:

1. What type of car is it?

This is probably the most fundamental check you can make. The type of car you’re investing in will play a huge role in its future value.

For example, a hand-built supercar from a prestigious manufacturer is obviously more likely to increase in value over time than a mass-produced family car.

So far, nothing new here. But we can break this down further. There are two factors we should look at in unison; body type and production volumes.

Body type

Whilst all types of car can appreciate in value, some are seen as more likely to than others.

Sporty and stylish cars are often seen as more desirable than their practical counterparts – who wouldn’t rather have a Jaguar XK, for example, over a generic SUV?

It’s for this reason that we often see certain coupes, roadsters, and supercars starting to appreciate once their values have plateaued.

But that’s not to say other types of car can’t or won’t appreciate. Plenty do, but they need another unique trait to make them stand out from the crowd.

Production volumes

Rarity is one of the most crucial factors when it comes to determining a car’s future value.

If you manufacture millions of cars, there are many examples available for the market to choose from. It’s basic economics; demand needs to outstrip supply for the value of a commodity to increase.

For example, a mass-produced hatchback is unlikely to draw the crowds at a car show, but a low-volume roadster might well draw some attention.

There is one caveat to this; it’s not only about the number of cars that rolled off the production line, it’s also about how many are remaining on the roads today. But we’ll go into more detail on that later.

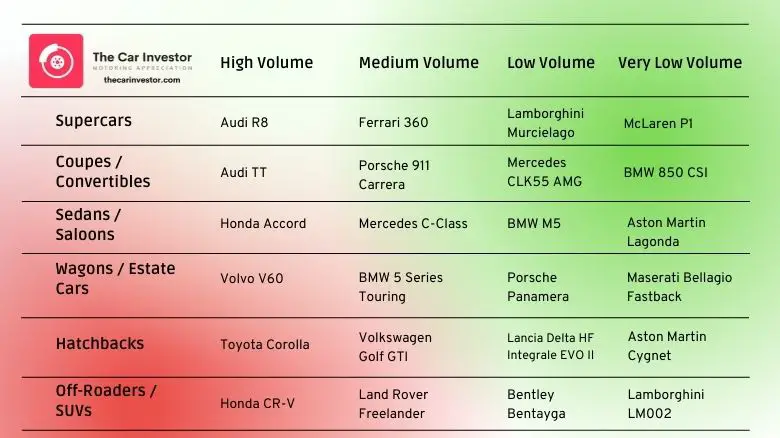

Where does the car you’re looking at fit into the desirability table below? We’ve included an example in each category.

2. What unique traits does the car have?

Cars considered ‘classics’ often have a number of unique traits that separate them from the more mundane motors that generally end up being scrapped.

Check that the car in question has one of the following traits. Having one or more of these is essential for it to appreciate in value significantly. The more traits that can be ticked here, the better.

- Offers great performance

- Was revolutionary when launched

- Has a connection with motorsport

- Is distinctive or different in some way

- Is considered good looking

- Is a limited edition version of an otherwise common car

A great example of a car that ticks most of these boxes is the BMW E30 M3. It was BMW’s first attempt at converting their everyday 3 Series into a racing car for the road, with the assistance of their ‘M’ Motorsport division.

It was only ever built in low-numbers, and these days is exceptionally rare. It paved the way for the BMW M cars of today, and as a result values have gone crazy over the last decade.

3. Is the car fashionable?

Fashion trends are an odd science, but as a collective we all seem to know what’s cool and what’s not. And it’s no good having a classic car that nobody thinks is cool.

Cars tend to go out of fashion towards the end of their production, but only a handful manage to eventually come back into fashion.

There are several ways that a car can find itself in fashion:

Nostalgia

Nostalgia is a powerful force, and there are some cars that will always take people back to their youth no matter what.

It has the power to take a previously irrelevant car and thrust it straight into the spotlight, especially when it’s driven alongside some of today’s more bland cars.

For example, any mass-produced family car from 25+ years ago that sold relatively well when new is bound to be a winner. There will be plenty of people who remember their parents and other relatives owning one, and they can look back fondly on those memories.

Even ugly cars can eventually find their way into people’s hearts via the power of nostalgia!

But it’s not just the generic cars of yesteryear that invoke nostalgia, which brings us to our next point…

Popular culture

Any car that appears in a blockbuster movie or hit TV show can suddenly find itself in demand. For some people, seeing an old-school Camaro in an episode of Stranger Things is enough to get them searching the classic car ads online.

Aston Martin’s long association with James Bond is a great example of how a car can become associated with a piece of popular culture. It’s given Aston’s cars universal appeal, and any car with a connection to 007 is now likely to do well in the long-term.

The TV show or movie doesn’t even need to be a new release. If its appeal was highlighted 20 or 30 years ago, it will still have an impact today. The Ferrari Testarossas in Miami Vice and Magnum P.I. are great examples.

In fact, some cars don’t even need to be featured to benefit. Seeing the Testarossa on screen brings back memories and sparks interest in the wide, boxy supercars of the 1980s, and similar cars from the same era can see a boost in value as a result.

Longevity

Another way that a car find itself fashionable is if it’s been able to stay relevant for many years after its production run has finished.

This is unusual, but we do see it every now and again, especially with some of the more outlandish cars.

The DeLorean, for example, is the epitome of ’80s kitsch, but that doesn’t mean it’s ever been uncool… despite its initial commercial failure.

The BMW E39 M5 is another example of a car that has always been cool, and even though prices did previously depreciate thanks to its costly maintenance bills, it’s long been regarded as one of the best cars BMW has ever produced.

Ultimately, any car that sticks in peoples’ minds as ‘cool’ or ‘fashionable’ for a long period of time is likely to increase in value given enough time and interest.

4. How expensive is the car to run?

We all know that classic motoring can be expensive, but to retain the interest of a suitable number of buyers over the years, it helps if the car is relatively affordable to maintain.

It doesn’t have to be cheap, just not prohibitively expensive.

When the costs of running an old car start climbing, word gets around and the buying pool shrinks as a result.

So not only are owners stuck with a car that’s costing them an enormous amount of money, but nobody will buy it off them. It’s at this point that supply starts outstripping demand, and values decline.

Many cars that have all the ingredients to become a popular classic end up being driven into the ground by owners who thought they could afford the ongoing costs, but couldn’t.

When this happens, the market can become flooded with bad examples, and prospective new owners need to be extremely careful when buying.

Most of the mistreated cars will drop out of the market sooner or later. What would once have been a relatively inexpensive fix can become uneconomical if the value of the car has dropped below the cost of the repair.

But a handful of well cared-for cars will make it through this period.

Ultimately, this new-found rarity will usually lead to values increasing again, but it does mean that some parts may be harder to find as a result, and the car may take longer to find the right buyer in the future.

5. How many are left?

As we’ve established, one of the most important factors in predicting whether the car you’re planning to buy will appreciate in value is how rare it is.

Certain cars drop off the roads quicker than others for a number of reasons. Perhaps they’re prone to rusting, or have a higher chance of being involved in accidents thanks to some questionable handling characteristics.

Whatever the cause, the rarer your car becomes during your ownership, the higher its value is likely to become.

Depending on where you live it can be quite difficult to establish how many of a particular car remain on the road, but some countries (such as the UK) provide publicly accessible data from their central database.

You can also utilise anecdotal data from forums, and keep an eye on used car sites over time to see how many come up for sale.

If the number is reducing year on year, it’s good news for your car’s value.

6. Has the car’s originality been preserved?

Lots of people like to modify their cars to suit their own tastes, and once a car has reached a certain age and has been through a number of ownership changes, it’s bound to have had the odd tweak here or there.

But that’s bad news for the car’s value. Car investors love the vehicles they invest in to be as close to factory-spec as possible. Which means no aftermarket exhaust and no tacky spoilers, people!

How the car has been used throughout its life will definitely have an impact here. Low-mileage cars will always have an advantage, and this is one of the first things investors look for when searching the classic car market, along with full service history (ideally from a main dealer).

Factory spec is also important. Did the car come with all the bells and whistles when new, or did the first owner skimp on the important extras?

And finally for this check, don’t disregard the color of the car. Some colors are more popular than others, and the used Ferrari market is a prime example of that.

A red Ferrari will always be infinitely more popular than a blue, black, silver, or any other colored example, which is reflected in used Ferrari values.

7. Does it have a cult following?

Any car with a cult following is bound to have an advantage for a number of reasons.

The number one reason is that there will always be plenty of willing buyers when the time comes to sell, providing the car is rare enough.

Many of those who have always loved the car may not have ever owned one, so there should always be a fresh pool of potential buyers.

Another benefit of having a large following is that there will always be plenty of information online should you ever need it. Popular classics often have their own dedicated forums with a whole host of info available.

What’s more, if you can’t find an answer to your question, there’s likely to be somebody who can help you out.

Sometimes unofficial groups are formed for owners of particular models. If this is the case with your car, it’s a great opportunity to make yourself part of the community. There are often meet-ups and events that you can take your car to.

All of this assures a continued supply of spare parts and aftermarket knowledge that can help keep your car running well into the future.

Will your car become a classic?

None of this is an exact science, but these are some of the checks that we make whenever we’re assessing the ‘future classic’ potential of a car.

Once you know what to look for, it becomes much easier to estimate the car’s potential and make an informed purchase.

Whether you’re buying for investment purposes or simply for the love of driving, you should be in a good place to make a shrewd judgment.

So there we have it, seven simple checks that will help give an indication of whether or not your next buy might become a classic in years to come.

And whatever future classic potential your next buy might be, one thing is for sure: they don’t make them like they used to!

ABOUT THE AUTHOR

Adam Chinn writes about the intersecting worlds of classic cars, driving pleasure, and smart investment strategies. Starting his journey at 26, he’s proven that one doesn’t need to be wealthy to begin investing in classic cars.

Adam’s insights have been recognized on platforms such as MoneyInc, Swagger Magazine, and Top Speed.

2 thoughts on “What Makes a Car Appreciate in Value and Become a Classic? (7 Simple Checks)”

I’ve just bought a 1993 Mercedes S600 V12 coupe with 214K on the clock.

The service records are all there and the suspension has been refurbished and the car’s interior and body work are great.

The official service record which has been followed throughout lists the next oil change at 225k.

These are not cars that you drive a long distance at my advancing age so I can’t see the problem as I don’t intend to go far.

The car cost me NZ $11,700 and I’m the third owner. It originally cost $350k and the second owner who died recently bought it secondhand in 1996 for $250k so how low can it go? If I spend a few more thousands I can get new engine mounts and refresh the steering, My government super cashed in at $12k so this car is my Kiwisaver investment that I drive myself.

I haven’t owned it long enough to have complete faith in it but if nothing has gone wrong in all those years I honestly can’t see why it can’t do another 30 or 40 ks for me while I wait to see how values turn out. I will spend any money needed to protect my investment and regard it as a further investment in my kiwisaver. Even if I wind up getting $20k for it that might be more than if I let the current investment market tear my super to pieces with “green” investments etc. Ha ha.

I’m simply betting that electric cars don’t ever take over despite how it may seem right now.

The S600 is a great way to go down to the swimming pool for a swim LOL.

Very interesting read. I own a 1962 Canadian Pontiac. It is a top of the line Parisienne 4 door hardtop or sport sedan with power steering and brakes, V8, automatic, with 122,000 miles in original shape. I am second owner. This car has not even had a windshield yet. Love the car, wish I could show you a picture. I know it is a keeper for sure. Love your sight, thanks from Manitoba, Canada.